The cap rate in real estate (or ‘capitalization rate’) is a core concept when it comes to commercial real estate. But despite this, the term itself is misunderstood by many, and sometimes used incorrectly altogether.

The following article aims to explain what the cap rate is, and give a better understanding of its relevance and true meaning.

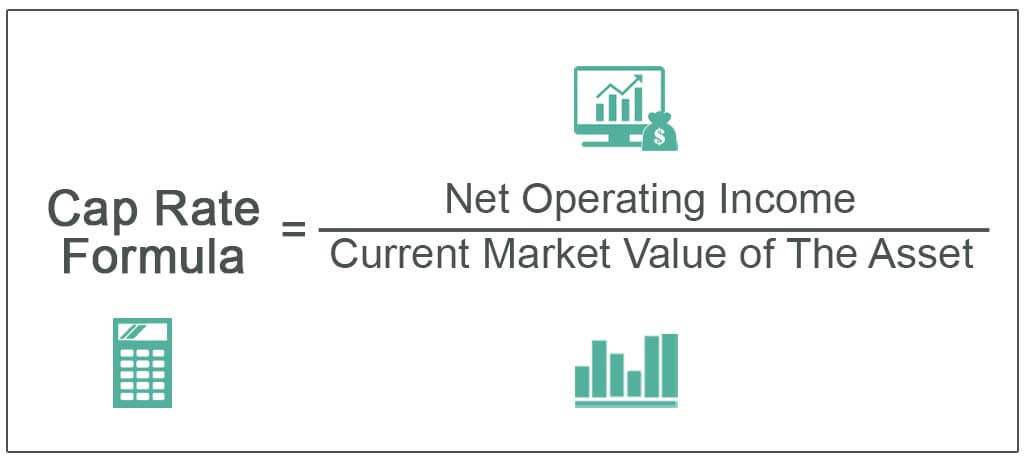

What is Cap Rate?

The cap rate – or capitalization rate – refers to the ratio of NOI (Net Operating Income) in relation to the value of a property. For example, if a certain property were to cost you $300,000 but also had an NOI of $30,000, then the capitalization rate of this property would be 10%, as $30,000 is 10% of $300,000. This term is also called ‘rate of return’ or ‘yield’ in other countries and regions.

What’s Considered to Be a Good Cap Rate?

There’s no set number of values that show what is a good cap rate. This is completely depending on the investor in question, as well as their goals and financial situation.

If you’re selling a property, then having a lower cap rate is beneficial, as this will give your property a higher value when on the sale market. But if you’re buying a property, having a lower cap rate will be more beneficial, as this will often result in a lower price for the property, meaning that your initial investment amount will be lower too.

But even this can add some confusion – as a ‘low’ or ‘high’ cap rate is completely dependent on properties within your region. The best way to work out if the cap rate of a potential property is high or low, is to put it in direct comparison with similar properties in the same or similar areas. Comparing properties in different markets or locations adds confusion, and can often lead to miscalculation.

When Should You Use Cap Rate?

There’s a reason the cap rate is currently a very common ratio to use. Experienced real estate investors know that it’s a valuable tool in determining whether a potential investment is worthwhile or not. To further assist investors in their decision-making process, many turn to real estate investor portal software. This software provides comprehensive features and data analysis tools that enable investors to evaluate properties, track financial metrics like cap rates, and make informed investment decisions.

Not only is it good for determining whether a particular property is worth purchasing, but when lots of properties are on the market, it’s great too for working out whether one property is better than another. If two similar properties are on the market, and one has a 12% cap rate vs. an 8% cap rate, this makes choosing the right property a lot easier.

But changes in cap rates over recent years also help create projections on where the market is going to go moving forward. By analyzing changes in cap rates, you’ll have a much better insight as to whether property values will go up or down.

Delving Into the Nuances of Capitalization Rate

The capitalization rate, more commonly known as the ‘cap rate’, of a property is influenced by a variety of components. Some are readily discernible, while others require a keen eye and thorough understanding of the real estate market. Often misconceived as a ‘risk-free return’ measure, the cap rate essentially estimates the potential returns an investment can generate without incurring any financial loss.

However, one must bear in mind that all investments, inherently, harbor a degree of risk. In the realm of property investments, legislative oversight and rigorous regulations significantly mitigate the risks involved. These risk reduction mechanisms often give property investments the impression of being ‘risk-free’, especially when considered in a long-term perspective.

Here’s a typical thought process of an investor: Suppose you possess $500,000. Investing this amount in a 10-year bond or a savings account ensures a safe, legally protected return of 5%. Now, if a property boasts a cap rate of 10%, it offers double the return compared to the bond or savings account. But remember, with increased returns comes amplified risk. It’s crucial for you, as an investor, to gauge if an additional 5% return is worth the escalated risk.

When scrutinizing a property, numerous factors contribute to its cap rate and the level of risk involved in investing. Some of these pivotal components include:

- The property’s age: Older properties may demand more maintenance and repairs, potentially affecting the returns.

- Tenant reliability: Dependable tenants who consistently meet rent deadlines contribute to a steady cash flow.

- Lease duration of current tenants: Longer lease terms can guarantee a more reliable income stream.

- Market competition: The number of similar properties available in the same region can impact the demand and rental rates.

- Macro factors: Broader factors such as total population, national housing culture, and GDP in relation to living situations also play a part.

Understanding these elements helps make an informed decision and successfully navigate the complex maze of real estate investment.

Conclusion

All in all, the cap rate is an extremely valuable tool in calculating whether a particular property is worth investing in or not.

Although properties with higher cap rates might seem more appealing due to the higher return they can offer, bear in mind that this also comes with added risk, and it may be worth going for a more consistent, ‘slow-burning’ investment just to ensure consistency and reliability.

If you are like most real estate agents looking for the best ways to generate real estate leads visit https://dorrmat.com/ to learn more about what is working for generating real estate leads.