Large financial decisions can be exciting and scary at the same time. For example, getting a new car can be exciting, but if it’s your first new car, it can be scary, too. Likewise, making major purchases like recreational vehicles or remodeling your home can be intimidating.

How should you determine what financial decisions are intelligent financial decisions? We’ve compiled a list of things to consider before making a large purchase.

When the extra expense is worth it

A quick rule of thumb is this…If your purchase will last a long time and it is high quality, the extra investment could be justified by the money saved over time.

High initial costs may be justified by the money it would save (or earn) for you in the long run.

When the extra expense is NOT worth it

Credit card companies like to offer users “reward” points on purchases, but those points aren’t doing much more than convincing you to go into debt.

The money mindset of you’re only young once, you only live once, or you can’t take it with you when you die is toxic to your bank account.

A mindset like the above usually invites the idea of spending freely and often leads to debt. An expense that needs justification may not be a wise investment. A 401(k) doesn’t require an explanation and is a good investment.

It’s essential to value the art of planning and budgeting

Having an idea of what your cash flow looks like is a wise place to start. Then you can begin to understand how much capital you have available to spend.

If you don’t have the cash on hand, going into credit card debt or taking out a loan will likely result in paying high-interest rates on borrowed money.

Therefore, it would be wiser to save up the capital to make a cash purchase than going into debt most of the time.

Creating a budget is ideal for finding how much money you spend and how much you have available for emergencies and large purchases.

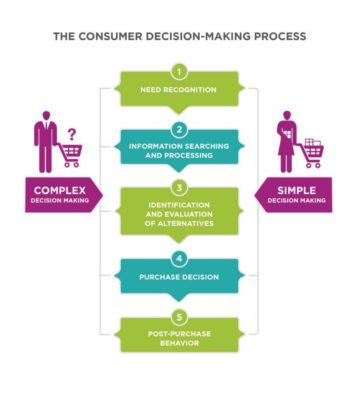

Research your options

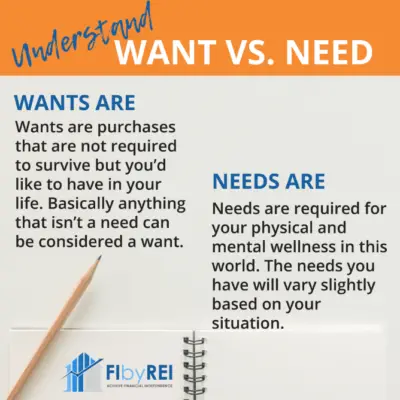

Is the purchase necessary, or can it wait? Knowing the difference between a need and a want could be the difference between financial security and financial emergency. For example, do you need a new dishwasher? Is there some way you can repurpose the old one or wash dishes with harvested water?

Try to find alternative routes or options, research them, and see which best fits your needs and interests.

Listen to experts

Financial advisors or financially well individuals will have the experience to share. They’ll probably be able to answer some of your financial questions and give you advice, so you don’t have to make the same mistakes they may have caused. Consult with advisors and make sure your decision is a financially sound one.

Listen to the numbers

If you made the purchase today, it’s essential to consider how that will affect your cash flow. In addition, it’s important to know if a significant financial decision would leave you scrambling for capital later. A budget app, like Mint, can help you keep track of your spending and savings to help you make a sound decision.

Would it increase your quality of life?

A new job that pays more may require you to make purchases initially, such as a nice uniform or a skills class. If you make those purchases and begin the new job, then you’ve traded the initial cost for less time for more pay. As a result, you spend more time doing what you enjoy doing for less money, increasing the quality of your life.

Read reviews about your purchase

If someone else has bought it, there are probably reviews on it. Research diligently before making significant purchases to avoid regretful financial decisions.

Reviews will often give insight into the shortcomings of a product. They may also highlight the pros of the purchase, too.

Is the purchase for a need or a want?

For example, if you have a distance to travel for work, you may want to get a car, but you could consider the alternatives before making a large purchase.

Buying a brand-new model will depreciate quickly; therefore, older models will be better investments.

However, you could also consider taking the subway, bike to work, or even walking, depending on your situation.

A bike would have health benefits, but a car would be faster, and you could travel further. Traveling further isn’t necessary but saving time to get to your destination might be.

Your situation and your needs will be different than someone else’s. If you’re unsure, find a financial advisor and see what they have to say.